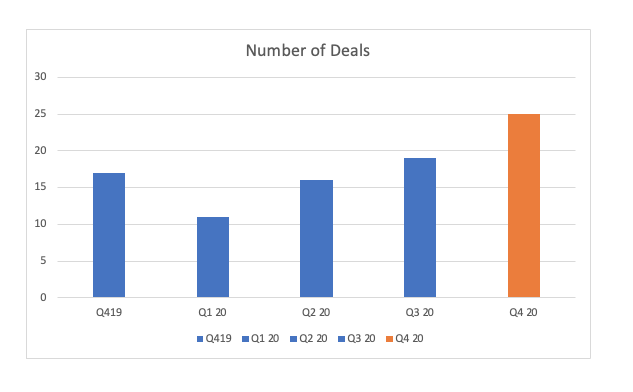

After starting off 2020 with a 35 percent drop in the number of deals from the previous quarter, digital therapeutic deal-making steadily climbed over the course of 2020 to total 71 deals for the year. With 25 deals in the fourth quarter of 2020, the index was up 44 percent from the fourth quarter of 2019.

The Q4 2020 buyer companies were a diverse group, ranging from Big Pharma (Bayer, BD, Novartis, Boehringer Ingelheim) to Accenture, which signed a deal to help launch Orexo’s digital therapeutic, and even Amazon (AWS signed a deal with Teva to support Teva’s Digihaler platform).

As in the third quarter, contract services deals dominated in Q4. With a total of 12, contract services deals accounted for nearly half of the 25 deals in the fourth quarter.

There were three acquisitions in the Q4, two by device companies (Mind Cure Health and WELL Health Technologies) and one was by diagnostics company Medidata.

There were also three R&D deals in the quarter. In one deal, Bayer announced it has established an in-house incubator for digital health. The program, dubbed G4A, initially invested in five start-ups.

And finally, there were two reverse merger/SPAC transactions. One involved Butterfly Network and the other was a three-way deal where SPAC GigCapital2 entered into two separate agreements with UpHealth and Cloudbreak to form one new entity that will be called UpHealth.

The large number of “not applicable” in terms of therapeutic area is the result of several platform technology deals. Three of the six neurology deals were for therapies that treat mental health.

Four companies were identified as infectious disease deals specifically related to COVID-19, but two were telehealth deals. Those telehealth deals are included in the infectious category because they specifically mentioned they target COVID-19 in their announcements. Therefore, they are not included in the telehealth category, which is new this quarter.

While the share of US buyer companies increased by half between the second and third quarters, in the fourth quarter it increased by one third. In the EU, German and Swiss companies both did two deals each. Ireland accounted for the fifth EU deal. Four deals by Canadian companies and one by an Israeli firm accounted for the rest-of-the-world deals.

Year-Over-Year

Looking at year-over-years data, digital therapeutic deals have grown at a steady and consistent pace over the past three years. Beyond that, the numbers from 2018, in particular, are too small to draw any meaningful conclusions. But I’ve done the charts just for fun. And here are a couple of thoughts:

- Neurology and diabetes have seen a lot of deals over the years, as digital apps are well-suited to remote monitoring and the management of behavioral health.

-

As I noted in the second quarter post, a surge in contract services deals in 2020 reflects how companies are scrambling to rapidly respond to the need to find new ways to interact with patients in a time of social distancing. (Note there was no data available for deal type for 2018.)

- While the number of US buyers and EU buyers were on par in 2019, that may be an anomaly as the US had a large lead in both 2018 and 2020.

Source: DealForma Database