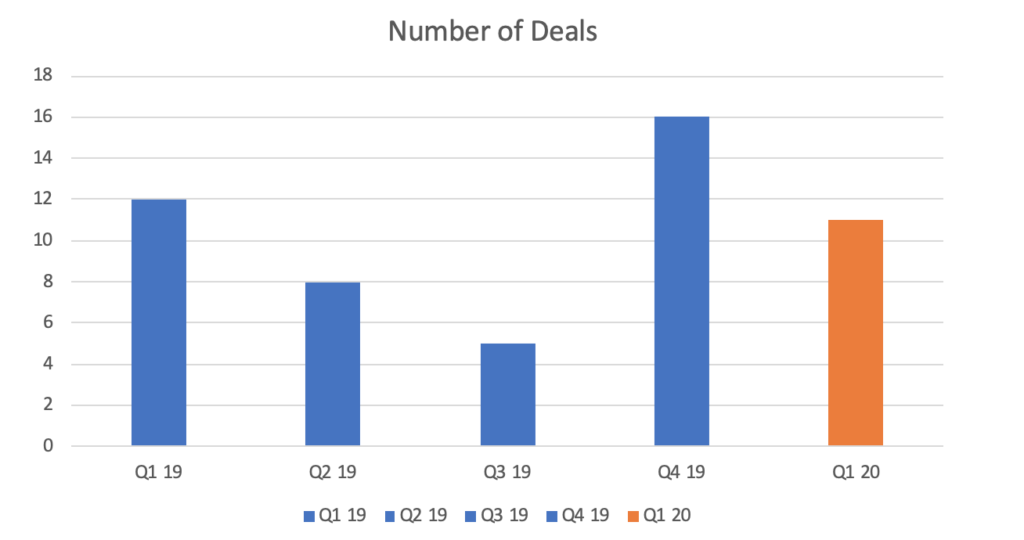

First quarter digital therapeutic deal data provided by DealForma shows a drop quarter-over-quarter from 16 transactions in the last quarter of 2019 to 11 in the first quarter of 2020. But year-over-year, the first quarter of 2020 is on par with the first quarter of 2019 when there were 12 deals recorded.

And deal flow didn’t slow after the COVID-19 virus became a global pandemic in late February. In fact, a third of the deals were announced between February 25 and March 25.

Early signs indicate dealmaking is not slowing down in the second quarter with Novartis already announcing its acquisition of Amblyotech, a Phoenix-based software company which is developing a treatment for lazy eye.

Q1 Highlights

While in the fourth quarter of 2019 it was Bayer that dominated the deal making, in the first quarter of 2020, it was Pear Therapeutics.

Pear licensed in three digital therapeutics, acquired two more (in one transaction), signed a research deal and signed a contract services deal all in the first two weeks of the year. Pear inked six deals in January including:

- Four neurology deals including one that beefs up its existing portfolio for the treatment of addiction,

- One deal with Apricity Health in the area of oncology and

- One deal with Karolinska Institut for a treatment for IBS.

Rounding out the deals for the first quarter:

- Brightinsight signed a contract services deal with AstraZeneca to develop apps, algorithms and software as a medical device (SaMD)

- Janssen is partnering with Voluntis to develop digital therapeutics

- Johnson & Johnson entered into a research partnership with Apple using Apple’s Heartline Study app

- ProQR is partnering with the Foundation Fighting Blindness and Blueprint Genetics on a program to provide genetic testing and counseling for patients suffering from inherited retinal diseases

None of the Q1 deals included details on the value of the deal or the payment structure.

By the Numbers

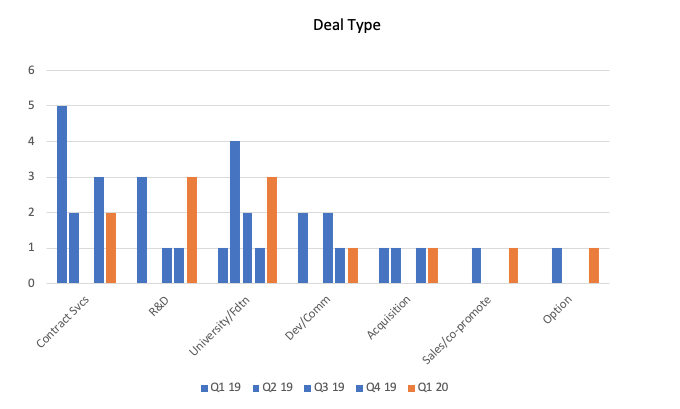

Without the crush of Bayer R&D deals that we saw in Q4, there is a much more even distribution of deals by type in the first quarter.

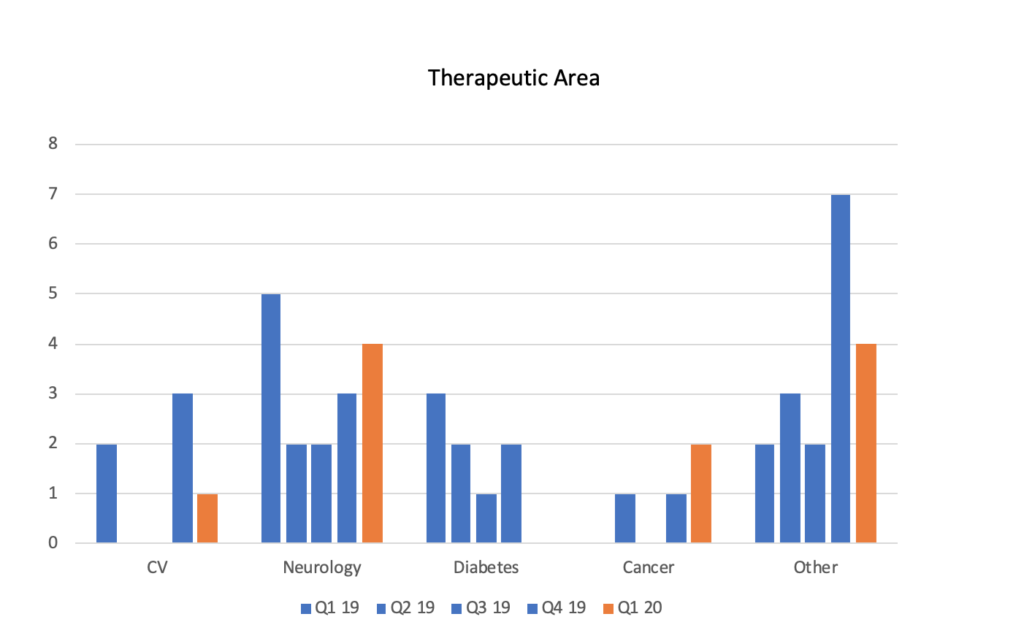

Neurology continues to be the most popular therapeutic area, no doubt due to the significant role behavioral therapy can play in many neurological conditions.

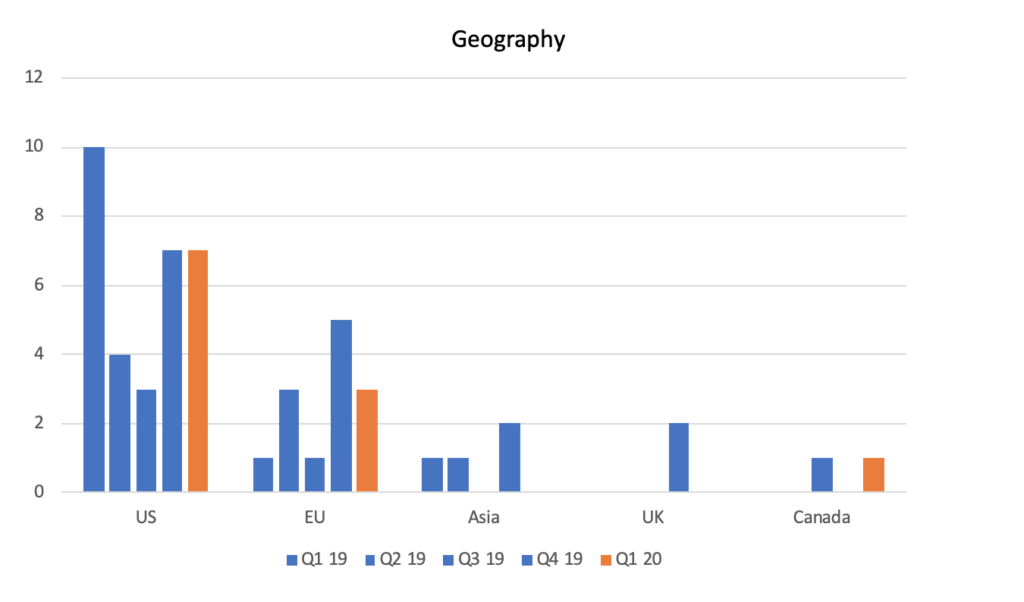

Most of the “buyer” companies continue to be domiciled in the US. Like the Q4 spike in R&D deals, the Q4 spike in EU-based companies is attributable to the Bayer deals.

Conclusion

In the Q1 CB Insights/PwC MoneyTree report, the authors note that the nine percent quarter-over-quarter drop in venture capital deal volume may be attributed to the COVID-19 outbreak. Year-over-year numbers also reflected a drop of 17 percent in the US and 20 percent in Asia, where the virus first emerged.

With digital therapeutic deals in the first quarter of 2020 tracking so closely to investment levels in Q1 2019, I’m not prepared to credit the quarter-over-quarter drop to COVID-19 yet. Another quarter should provide a better picture on the impact of the global pandemic on the appetite for digital therapeutics.