Digital therapeutic dealmaking bounced back to Q4 2019 levels in the second quarter of the year. After a first quarter where deal-making was stymied in by the onslaught of COVID-19, buyers came back big-time in the second quarter once the reality of the “new normal” began to become clear.

Q2 Highlights

DealForma reported 15 deals in the second quarter, up from 11 in Q1. At this pace, the sector is on pace to record 53 deals in 2020, up nearly a third from 2019.

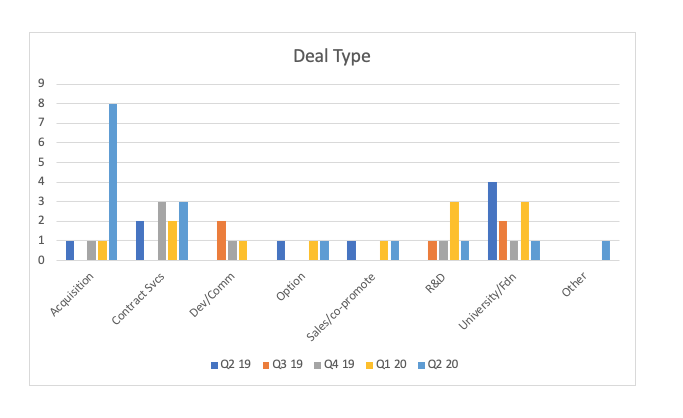

Of the 15 deals in the second quarter, eight were acquisitions – all friendly. That compares to only three digital therapeutic acquisitions in all of 2019 – and one in the first quarter. As treatment paradigms for COVID-19 are moving care out of the clinic and closer to the patient where possible, it appears digital therapeutics look like a good bet.

Unlike the prior two quarters, no single buyer dominated the deal-making. Only Novartis and The DNA Company did more than one deal in the quarter.

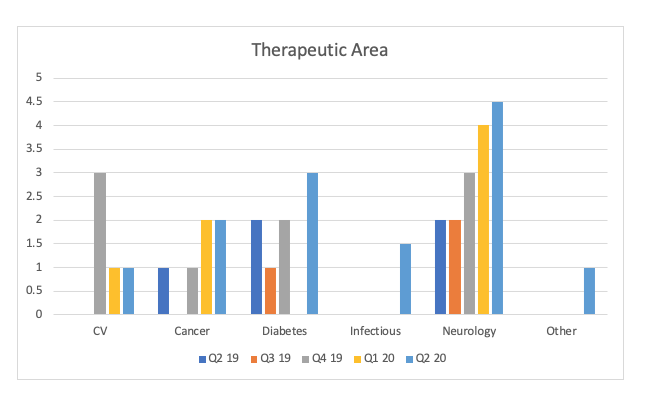

As might be expected in the age of COVID, infectious disease made its first appearance among therapeutic areas in the second quarter. There was one straight up COVID-centric deal in the Apple/Google tracking project. My Next Health, a spin-out from The DNA Company, is described as an app for both the treatment of chronic pain and COVID-19.

Aside from infectious disease, neurology deals continue to top the list at four and a half (the half being My Next Health). Diabetes, with three deals, came in second.

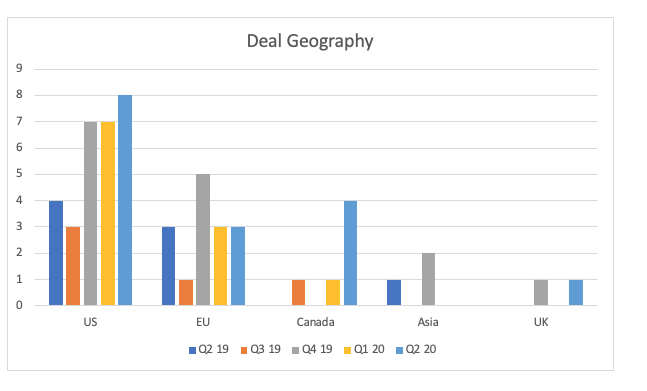

In terms of geography, US companies continued to lead the pack when it comes to digital therapeutic dealmaking in the second quarter. Canada jumped to second place on the back of the two deals done by The DNA Company.

While we haven’t been including telemedicine deals in our analyses, it is worth noting that there were three telemedicine deals in the second quarter, two acquisitions and a joint venture. With the rise of telemedicine in the era of COVID, these companies may well morph into more than just secure pipelines connecting patients and physicians. They may come to play a bigger role in diagnosing and treating disease.

Q2 Deal Summary (in reverse order by date announced)

- Tandem Diabetes announced its acquisition of Sugarmate in late June.

- Sharecare expands its digital therapeutics platform with the acquisition of tobacco cessation app developer MindSciences in June.

- In late May, Sweden-based, Elekta acquires Kaiku Health to strengthen its oncology portfolio.

- Canadian CBD company New Leaf Brands (now Mydecine) announced its acquisition of Mindleap Health, developer of a digital therapeutic platform. The deal was announced in May.

- Swedish biopharma Orexo AB signed a contract research deal with Lyfebulb of New York related to its development of digital therapeutics for the treatment of additions.

- The Canadian direct-to-consumer genomics company The DNA Company has acquired My Pain Sensei for CA$30 million.

- The DNA Company has also formed My Next Health, based in New York, to develop AI-based applications for the treatment of chronic pain.

- LifeScan has entered a contract services deal with Noom to develop the OneTouch Reveal app for the management of diabetes.

- The Mayo Clinic has contracted with Ultromics to develop an AI-based image analysis application for identifying and monitoring heart disease in COVID-19 patients. The deal also includes a research partnership with Ubisoft and McGill University.

- Canadian biopharma GAIA has granted Orexo exclusive rights to commercialize its digital therapy for the treatment of depression in the US.

- In April, Novartis announced the acquisition of Amblyotech, an Atlanta, GA-based software company developing a digital therapy for amblyopia (“lazy eye”).

- Biofourmis is acquiring Takeda’s Gaido Health with the intention of expanding its digital therapeutics portfolio in cancer.

- Diabetes management platform company One Drop acquired Sano Intelligence including Sano’s continuous glucose-sensing platform.

- Google and Apple announced that they are joining forces to develop a contract tracing platform to reduce the spread of COVID-19.